Take Advantage of the 2025 Section 179 Deduction with Hunter Truck

If you’re planning to add or upgrade equipment before the end of the year, Section 179 of the IRS Tax Code could help you save big. Designed to support small and midsize businesses, Section 179 allows companies to deduct up to $2.5 million of qualifying equipment purchases made in 2025 — all in the same tax year that the assets are placed in service.

For fleet owners, that means assets like new and used semi-trucks, shop tools, and diagnostic equipment can translate into an immediate reduction of taxable income, allowing you to reinvest those savings right back into your business.

What Qualifies For the Section 179 Deduction?

Section 179 covers a wide variety of assets so long as they are tangible, purchased (not leased on an operating lease), and used more than 50 percent for business during the tax year. This includes:

- Class 8 tractors, day cabs, and medium-duty trucks (new and new-to-you)

- Trailers and attachments

- Technology (both hardware and software upgrades)

- Facility improvements

- Shop and support equipment such as lifts, compressors, or diagnostic tools

The key is timing: the unit must be purchased, paid for, and placed in service (ready to work) by December 31, 2025.

Why Buy A Truck Now?

At Hunter Truck, we have a wide variety of ready-to-work trucks in stock today. From dump bodies and roll-offs to fully spec’d sleepers, our inventory includes a range of configurations to meet your business needs. You can view our current inventory right here.

Don’t wait until the year-end rush. Purchasing now ensures your truck is delivered, titled, and operational in time to qualify for 2025 tax savings.

Next Steps

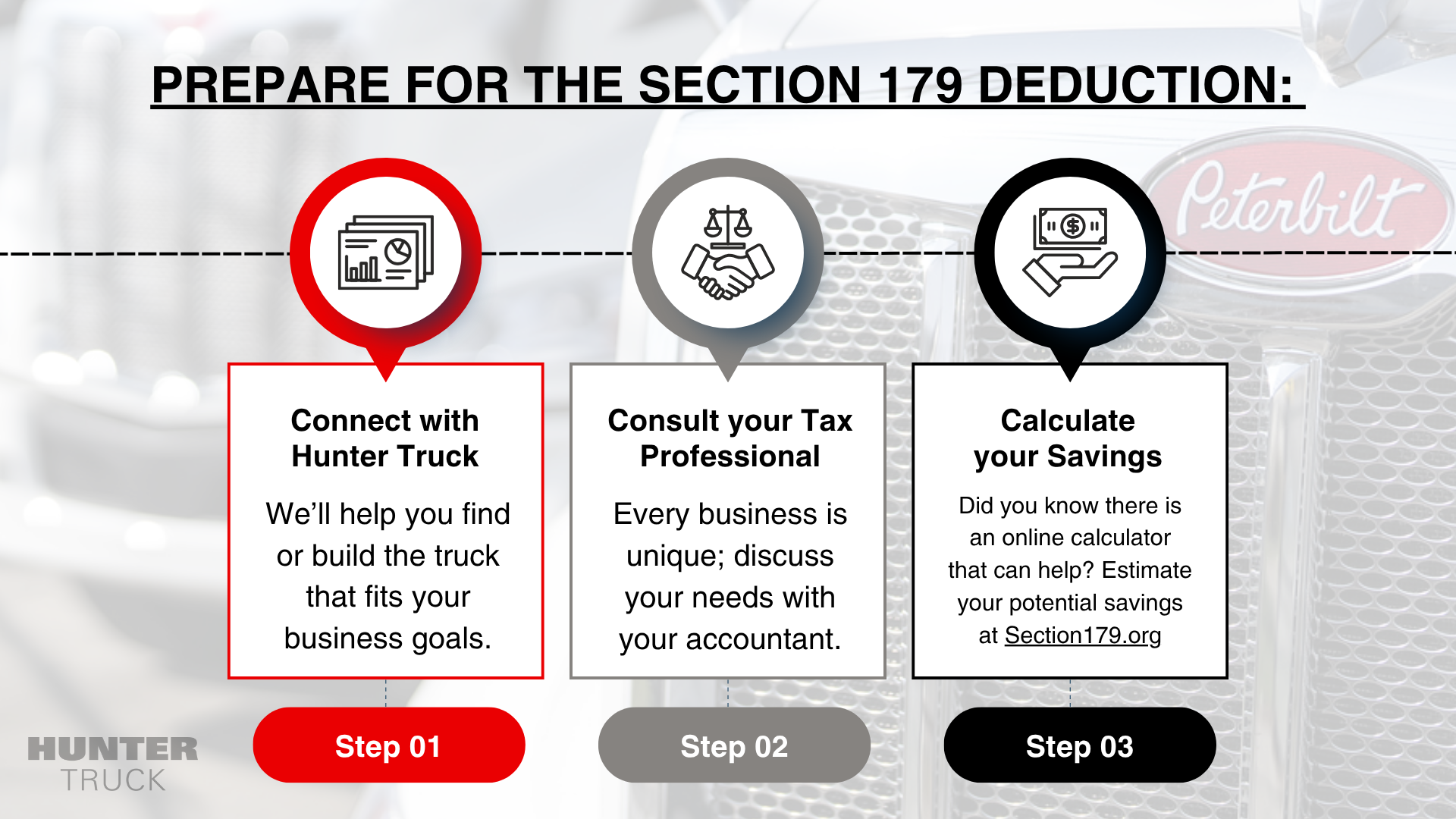

- Talk to your Hunter Truck sales professional.

- We’ll help you find or build the truck that fits your business goals and delivery timeline. View our location page for a dealership near you, or fill out our contact form and we will follow up with you directly.

- Consult your tax professional.

- Every business is unique — your accountant can confirm eligibility and help you maximize your deduction.

- Use the Section 179 Calculator.

- Did you know there is an online calculator that can help? Estimate your potential savings at Section179.org

Disclaimer:

Hunter Truck does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax advice. Businesses should consult their own tax advisors regarding Section 179 qualification and deductions.